NJMEP: Unionwear’s Workforce Success Story in Domestic Manufacturing

NJMEP’s Mike Womack wrote an article in Manufacturing Matters about Unionwear, summarized here.

The Secret Behind Unionwear’s Domestic Manufacturing Achievement

At a time when so many American industries struggle to maintain their presence on home soil, Unionwear stands proud as a testament to determination, innovation, and a skilled workforce. Mitch Cahn, President of Unionwear, built the company on the foundation of American manufacturing, particularly in the baseball hats and sewn bags sectors. Unionwear’s unwavering commitment to domestic manufacturing and its unique approach to workforce development have ensured its continued success in a fiercely competitive global market.

Unionwear’s Origin: The Birth of a Hat Company

Unionwear began in 1992 with Mitch Cahn’s vision to create baseball hats for the burgeoning fashion industry. At the time, baseball hats were primarily worn in sporting events and promotional activities. However, Cahn observed a growing trend of baseball hats in popular culture that was not yet reflected in the retail space.

Cahn recognized an opportunity and seized it, purchasing the equipment from a defunct baseball hat factory in Jersey City and hiring its original six employees. Fast forward to today, and Unionwear boasts around 135 full-time employees and a successful track record in the textile industry.

The Workforce Secret: Maximizing Employee Potential

Unionwear’s achievements are a direct result of its commitment to its workforce. The company utilizes automation not as a tool to replace jobs, but to optimize the productivity of existing employees. By investing in state-of-the-art technology and continuously improving its manufacturing processes, Unionwear can keep pace with – and even outshine – its rivals in the industry.

The Challenge of Training and Development

But technology is just one piece of the puzzle; another crucial factor lies in the development of Unionwear’s human capital. Mitch Cahn emphasizes the importance of ongoing training and nurturing employees to reach their full potential, noting that the management’s role is to ensure workers are well-versed in the best practices for the company.

In a world where skilled laborers are becoming a scarce resource, Unionwear has found a way to attract and retain talent by offering a well-structured onboarding program that clearly defines employees’ roles and responsibilities. This streamlined process, alongside effective vetting and analysis of candidate strengths, ensures that new hires are set up for success from day one.

The NJMEP Partnership: A Win-Win Collaboration

For nearly two decades, Unionwear has worked closely with the New Jersey Manufacturing Extension Program (NJMEP), which provides vital support to manufacturers in the state. The NJMEP has placed professionals in a variety of non-production roles within the company, helping to fill vacancies and strengthen its workforce further.

The NJMEP partnership is particularly valuable as Unionwear seeks to attract young talent to the manufacturing industry. With an average full-time manufacturing employee salary approaching six figures annually in New Jersey, the opportunity for a well-paying, challenging career in the sector should be more than enough to grab the attention of job seekers.

The Unwavering Commitment: Keeping Manufacturing Domestic

What truly sets Unionwear apart from other manufacturers is its commitment to domestic manufacturing, using continuous improvement, lean manufacturing, automation, and technology to produce high-quality products in a fiercely competitive global market. The company remains dedicated to ensuring its workforce is equipped with the skills required to drive its ongoing success, with sustainability and growth at the forefront of its agenda.

In conclusion, Unionwear is an inspiring example of how a small, determined manufacturer can flourish on American soil. Its dedication to developing its workforce and providing high-quality products has made the company a shining beacon and a case study for other companies seeking to make their mark in domestic manufacturing. As a company built on true American values and an undying patriotism, Unionwear symbolizes the successful marriage of skilled labor and visionary leadership – truly, a story of manufacturing success made in the USA.

A new kind of union leadership is transforming Philadelphia

According to Philadelphia Magazine, a new kind of union leadership is changing Philadelphia, and getting results.

Jerry Jordan of the Philadelphia Federation of Teachers, Chris Woods of AFSCME 1199C, and Ryan Boyer of the Laborers District Council are making their mark. Jordan’s PFT spent north of $340,000 on political campaign contributions last year; Boyer’s Laborers spent more than $2 million. When the pandemic hit and hospital workers at Temple demanded hazard pay, Woods promptly called all of his political allies to let them know about his membership’s plight. Hazard pay arrived shortly thereafter.

What is notable here is that all of these union leaders are black. “We’re forced to be much more than a labor organization,” says Boyer. Indeed, the unions are getting squarely involved in social justice issues as much as bread-and-butter labor union ones.

To stay relevant, some labor unions are going beyond bread-and-butter economic issues for their members. The PFT also assembled in front of the Comcast Tower, demanding free internet so students whose families couldn’t afford access could still attend virtual school during the pandemic.

And it’s why AFSCME 1199C reemphasized its campaign for social justice during the George Floyd protests. “We want to be in conversations not just as relates to police, but to the whole criminal justice system,” says Woods. “Because these are issues that affect our members.”

Podcast: The Fall and Rise of USA Cap Manufacturing

Red Pilled America took a deep dive into the history of the baseball cap, and used the story of offshoring ballcap production to tell the story of American apparel manufacturing.

Episode 24 focuses on Unionwear’s history. Founded as a fashion industry contractor, Unionwear was nearly shuttered when unintended consequences of trade deals resulted in most of the textile business moving to China in the mid 90’s.

Unionwear took a systematic approach to seek markets that would only buy American: starting with unions, moving to political campaigns, the US government and military, then other manufacturers and nonprofits, and now back as a fashion contractor.

Hosts Patrick Courrielche and Adryana Cortez intersperse Unionwear’s story with a fascinating analysis of the economic, regulatory, and systemic changes that resulted in American manufacturing losing its edge, and what it would take to regain it.

The podcast has started a kickstarter campaign to sell a Red-Pilled America cap, pictured above.

The podcast is broadcast by iHeartAmerica and is available on Apple Podcasts

Upstart: Makers Movement Panel Discusses “USA Made” Cost Myths

by Teresa Novellina for Upstart Business Journal

When Matthew Burnett, founder of Makers Row, launched his own watch line in 2007, he followed the advice he had always heard and went straight to Asia to get them manufactured, believing the costs would be less.

But because he was a new brand, and wasnít placing huge orders at once, he ran into problems that hurt his business.

“My largest order was the factory’s smallest order and I was always getting pushed to the back of the line,” Burnett recalled in a panel talk at Northside Festival Friday. That problem led to first a much-improved arrangement domestically (more expensive, but ultimately worth it), and eventually his New York City-based startup, Maker’s Row, an online network of U.S. factories that he launched in November 2012 and which connects designers with domestic factories.

His company tapped into a trend toward made-in-the USA brands, one that panelist Mitch Cahn of made in the USA manufacturer Unionwear says has little to do with patriotism but plenty to do with buying local, environmentalism, and a growing demand for better workers’ rights. His Newark, N.J.-based manufacturing firm, which supplies unions, government organizations and others with apparel and accessories, now has fashion designers calling.

“There are a few misconceptions about Made in the USA,” Cahn said. Among them: that the cost of raw materials is more expensive here. In fact, prices on imported textiles have been rising 25 percent a year for the past few years, and “we’re in the ballpark” on textile prices in the United States.

Meanwhile in China, labor costs are on the rise, and workers are demanding better conditions as well.

While labor costs remain higher here, one cost-saving strategy he has found that works is what he calls “lean manufacturing,” which he says makes sure that people involved in labor spend as much time as possible on activities that improve the quality of the final product, and represent an improvement “that your customer is willing to pay for.”

Jeff Sheldon, the founder of Ugmonk, is a graphic designer whose e-commerce company uses American suppliers. It’s pricier, but he saves in the long run. For instance, because the brand uses a screen printer domestically (for which they paid more), they’ve built a relationship that means when he has a rush order, Ugmonk gets pushed to the front of the line.

“I think itís really true that you get what you pay for,” Sheldon said. “I’ve learned that if you ask for cheap or the best quality you’re going to get one or the other.”

Source: http://upstart.bizjournals.com/entrepreneurs/great-mistake/2014/06/13/makers-movement-founders-talk-made-in-usa.html

Making Made in USA Easier: New Tools for Designers To Find Contractors

When they came face-to-face with an angry broker, whose business was threatened by their new website Maker’s Row, Matthew Burnett and Tanya Menendez knew they were on to something.

“He came to our office and threatened to shut down the site because that was his livelihood,” said Burnett in the Brooklyn, New York office of Maker’s Row, the site they believe is making easier and cheaper for entrepreneurs get their products made in the U.S.A

“It was a telling sign of the disruption that was going on in the industry,” adds Menendez. She recalled the incident had left her looking both ways, when leaving the office. “This is like a big guy, who comes in … huge presence. We felt really uncomfortable, but it was also really enlightening for us.”

Despite the decline in U.S. manufacturing, a “Made in the USA” label is still desirable in global markets.

It brings a certain assurance that products are made according to high production standards, using safe materials. Over the years, that label has also become synonymous with high labor costs. But the cost of foreign labor is on the rise, and it’s beginning to level the playing field for U.S. manufacturers.

Finding a domestic manufacturer, however, can be time consuming. Most brands don’t like to share manufacturing information because they don’t want to help their competition. “It was almost taboo to ask,” Burnett said.

Supporting local manufacturers

The timing is certainly good for Maker’s Row.

There’s a lot of confidence among U.S. manufacturers these days. A recent survey by the Boston Consulting Group revealed that 16 percent of the 252 U.S. manufacturers who responded are re-shoring jobs from China, a 20 percent jump from a year ago, and more than double the number that were doing so back in February 2012.

Back then, Burnett and Menendez were just beginning to wonder how they could find enough manufacturers to make Maker’s Row a success. It was a tough sell at first, but they began to list manufacturers on the site for free, which turned out to be a smart move because some of them saw almost immediate results.

“People started to see leads before Maker’s Row asked them to sign up for their service,” according to Mitch Cahn, who runs Unionwear, a maker of baseball caps and bags in Newark, New Jersey. With leads in hand, it became much easier for Burnett and Menendez to sign up other manufacturers.

“We get several inquiries a day from Maker’s Row,” says Cahn, who bought a former baseball cap factory in nearby Jersey City back in 1992, when he says there were about 400 baseball cap manufacturers in the United States. These days, he says there are only about four but he believes the playing field for domestic manufacturers has leveled because the cost of labor overseas is climbing dramatically, making “Made in USA” more of a reality, than a lofty ambition. “There had been interest before but it was really a lot of talk,” he says, “Now that the price differential is so much smaller people are saying, ‘Hmmm, I may spend another 20 percent to get a product ‘Made in the USA.’ Five years ago, it might have been another 100 percent.”

Local governments have gotten on board to help Maker’s Row, hoping to help their local manufacturers at the same time. They’ve had a large number of signups in Los Angeles and Chicago too. In about two years they’ve signed up approximately 5,000 manufacturers. A good thing, because there are also about 50,000 brands using the site to look for help. Subscriptions to Maker’s Row begin at $25 a month.

Shifting manufacturing

It’s a similar story at Genil Accessories in Brooklyn, where Gina Bihm and her staff make bow ties and neckties for the likes of Vineyard Vines and Marc Jacobs. Despite her big name clients, Bihm says she’ll also tries to help the little guy create samples, if they can find her, “I don’t turn away no one. No one,” she says.

Bihm said the recession which began in 2007 nearly put her out of business. At the time she was shipping out about 20,000 pieces per year. In 2008 and 2009 work was hard to come by. Her entire staff, once numbering about 20 full-timers, was cut to zero. She needed a loan to pay the rent on her work space. She still has only 11 full-time employees but she says business is better than ever. With bow ties back in vogue, they’re making about 4,000 units per week now.. and that was before she found Maker’s Row. They’re practically around the corner from each other but Bihm only signed onto Maker’s Row during the summer. “The phone calls doubled. I picked up about seven new customers and they all came from Maker’s Row,” Bihm said.

Those are the same reasons that Burnett believes Maker’s Row has seen some foreign businesses come on line looking for U.S. manufacturing. “we’re looking to change the rule of thumb,” Burnett said, “we’re changing that mindset by showing people where they can produce and manufacture locally because this is a global shift right now.”

Upstart Journal: Makers Movement Panel Discusses “USA Made” Cost Myths

Upstart Journal

by Teresa Novellina

When Matthew Burnett, founder of Maker’s Row, launched his own watch line in 2007, he followed the advice he had always heard and went straight to Asia to get them manufactured, believing the costs would be less.

But because he was a new brand, and wasn’t placing huge orders at once, he ran into problems that hurt his business.

“My largest order was the factory’s smallest order and I was always getting pushed to the back of the line,” Burnett recalled in a panel talk at Northside Festival Friday. That problem led to first a much-improved arrangement domestically (more expensive, but ultimately worth it), and eventually his New York City-based startup, Maker’s Row, an online network of U.S. factories that he launched in November 2012 and which connects designers with domestic factories.

His company tapped into a trend toward made-in-the USA brands, one that panelist Mitch Cahn of made in the USA manufacturer Unionwear says has little to do with patriotism but plenty to do with buying local, environmentalism, and a growing demand for better workers’ rights. His Newark, N.J.-based manufacturing firm, which supplies unions, government organizations and others with apparel and accessories, now has fashion designers calling.

“There are a few misconceptions about Made in the USA,” Cahn said. Among them: that the cost of raw materials is more expensive here. In fact, prices on imported textiles have been rising 25 percent a year for the past few years, and “we’re in the ballpark” on textile prices in the United States.

Meanwhile in China, labor costs are on the rise, and workers are demanding better conditions as well.

While labor costs remain higher here, one cost-saving strategy he has found that works is what he calls “lean manufacturing,” which he says makes sure that people involved in labor spend as much time as possible on activities that improve the quality of the final product, and represent an improvement “that your customer is willing to pay for.”

Jeff Sheldon, the founder of Ugmonk, is a graphic designer whose e-commerce company uses American suppliers. It’s pricier, but he saves in the long run. For instance, because the brand uses a screen printer domestically (for which they paid more), they’ve built a relationship that means when he has a rush order, Ugmonk gets pushed to the front of the line.

“I think it’s really true that you get what you pay for,” Sheldon said. “I’ve learned that if you ask for cheap or the best quality you’re going to get one or the other.”

Source: http://upstart.bizjournals.com/entrepreneurs/great-mistake/2014/06/13/makers-movement-founders-talk-made-in-usa.html

Unionwear’s Featured TedX Talk: Made Right Here

Unionwear President Mitch Cahn’s 15 Minute Ted Talk–Made Right Here: How the international worker rights and buy local movements are creating a surge in U.S. urban manufacturing opportunities. The talk discusses why the premium for domestic goods are shrinking, and the five types of business to business to market segments with strong convictions about buying USA Made.

TRANSCRIPT

Manufacturing is booming in Newark and other American cities after decades of decline.

Newark, NJ has over 400 active factories within the city limits that employ over 10,000 people. Four years ago nobody knew this, now a growing number of people know this. How did this happen in the middle of a recession? Well, as a manufacturer, I can’t say it was anything that our industry did. I am pretty sure it wasn’t anything that our government did. And I don’t think it was a wave of made in USA consumerism that pushed us over the edge.

What happened was over the last 20 years, goods have been made overseas in the third world very, very cheaply on the backs of exploitation of labor and exploitation of the environment. The growth in manufacturing now is because both “overseas” and “exploitation” have become a lot more expensive and a lot less attractive.

Activists did this–labor activists did this, unions, worker rights coalitions and environmental and buy local activists made this happen. They raised awareness, they localized supply chains and they helped to impose regulations creatively. And as a result we’ve seen what’s going on in Newark right now. “Made in USA” has relatively become a bargain. Cities like Newark are reaping the benefits because we have an infrastructure in place still from the 70’s and before that, we have a lot of concentrated labor and we are in the center of a transit hub. We have the ability to move people and goods around very quickly. We are within a day’s drive for something like a third of the population.

What I want to do now is talk about my experiences running Unionwear, which is a manufacturer of baseball hats, bags like backpacks and garment bags, safety vessel scrubs. We manufacture everything from scratch right here in North Newark. We have about a 110 union workers, we are 11 miles from Midtown Manhattan. We have been in business for 21 years. In almost every product category of ours, we might be the most expensive place to make that product in the entire world. So how is that over the last four or five years we’ve grown by about 25% per year after about a decade of being flat.

Well we’ve narrowed it down to five areas. One is market forces, specifically understanding the market forces that are going on and being able to educate our clients about it. How is Obama care going to affect domestic manufacturing? How is immigration policy going to affect in manufacturing. What if China decides to float their currency against the United States? Is that going to make United States manufactured goods less expensive? And more appealing to the rest of the world? Yes.

We stay on top of these things and we make sure clients know about them because changes in the economy happen right under people’s noses and they don’t even see it.

Market selection is a big one. There are markets that want to buy local. There are markets that want to buy made in USA. It’s more expensive to buy those things but they are willing to pay a premium. Who are those people and how do we reach them?

Product selection is an area that goes along with market selection. Now someone might not be in a market that wants to buy made in USA but they might want to be a product that might be less expensive to manufacture in United States, so what are those products?

Re-engineering is important because it’s very different to manufacture a product where there is no regulation and people are paid ten cents an hour versus where it is manufactured in an area where there is a lot of regulation and people make 10 to 15 dollars an hour. You can bridge that gap through smart re-engineering.

Finally we take advantage of our geographic advantages. We play up how close we are to New York City and Newark airport and port Newark and millions of skilled laborers.

So I am declaring right now the era of cheap imports is over. It’s dead.

So what’s happened as the price of imports increases is the premium paid for made in USA product shrinks. As that premium shrinks it becomes less expensive for people to have sourcing standards or enforce standards that they already had. So what happens and why the market is grown is there are a lot more people who are willing to pay 25% more for a product that’s made green, made in USA, made union, then they were in 2008 when it might have been 200% or 300% more expensive for that same thing. And it is that a big of a difference.

So one reason for this is labor supply and demand. China has had decades of a one child policy, and as a result there are a lot fewer people entering their workforce now and the people who are entering the workforce, they don’t want to make the iPhone, they want to work for Apple. So there are not enough people working in these factories–when that happens you have to pay people more to get them to work in manufacturing.

As a result of people being paid more there is now a consumer class in China and in India and in Pakistan. That’s driving up the costs of goods, its driving up the costs of gasoline, petroleum which is making goods more expensive to ship to United States.

I put a slide up of the iPhone factory because that’s an example of what has happened because of worker rights activists. When all of the working violations at the Foxconn factory where over a million people are employed were discovered, labor activists came in and negotiated a 40% wage increase and they lowered the amount of hours they can work from a 100 hours a week to 60 hours a week. They came in a year later and negotiated another 40% increase. You imagine what it does when a million people make that much more money. And have to work that fewer hours. They have to scramble the find workers. That’s why prices have been of imports have been going up so much.

And as a result of social media, the rest of the world’s workers are finding out what’s going on and realizing they don’t have to work this way. So you are seeing the same sort of riots, protests, strikes in Bangladesh and Pakistan. This has led to wage inflation of 25% to 30% a year. The response overseas has been to cut corners– poison in pet food, poison in dog food, exploding tires, broken plane parts, that’s led to more regulation which has put more expense on products that come in from overseas.

Companies have moved their manufacturing to places that they thought were cheaper than China like Bangladesh. But they didn’t have the infrastructure and ended up being more expensive. You ended up with month after month, factory fires and factory collapses which led to more regulation and more expense.

So who is buying made in USA, now that their premium has shrunk?

There are five different ways that people can say “buy local” and these are the markets that we try to appeal to. Buy American, people buy American for economic reasons, or if they have standards like the US government. Or if they want consistent messaging, like General Motors who makes goods domestically and they want to buy American-made goods because they are selling made American.

People want to buy union and support their fellow union workers.

People want to buy fair labor, they don’t want to buy goods that were made in a sweatshop.

People want to buy eco-friendly and people want to buy local.

So one of the of the areas that wants to buy American is the US government which makes up about a quarter of our GDP. This is something that is relatively new, this enforcement of the government buying American made goods.

Another area is trade justice and if you say the labels fair trade and sweat free and living wage on goods, those are all ways of saying that these goods were made by workers who are not exploited.

An example of someone who used to not buy products with these labels in is now is NPR. They would give away tote bags for memberships at the same time they were doing stories about sweatshops in China but the tote bags were made in those sweatshops because they get them for 25 cents a piece. Now it’s costing them $2.50 a piece to import. They are going to spring for $3 a piece and buy something that is made in USA and it basically cost less for them to put their money where their mouth is.

The link between fair labor and local and eco-friendly is this: The closer production is to consumption the less acceptable worker exploitation becomes. You don’t want to buy a shirt from someone around the corner who you know as working for below minimum wage and maybe working a 100 hours a week, but its okay if it is around the world.

Also the more likely that goods are produced using your labor and environmental standards. The factories are operating under the same laws that you benefit from.

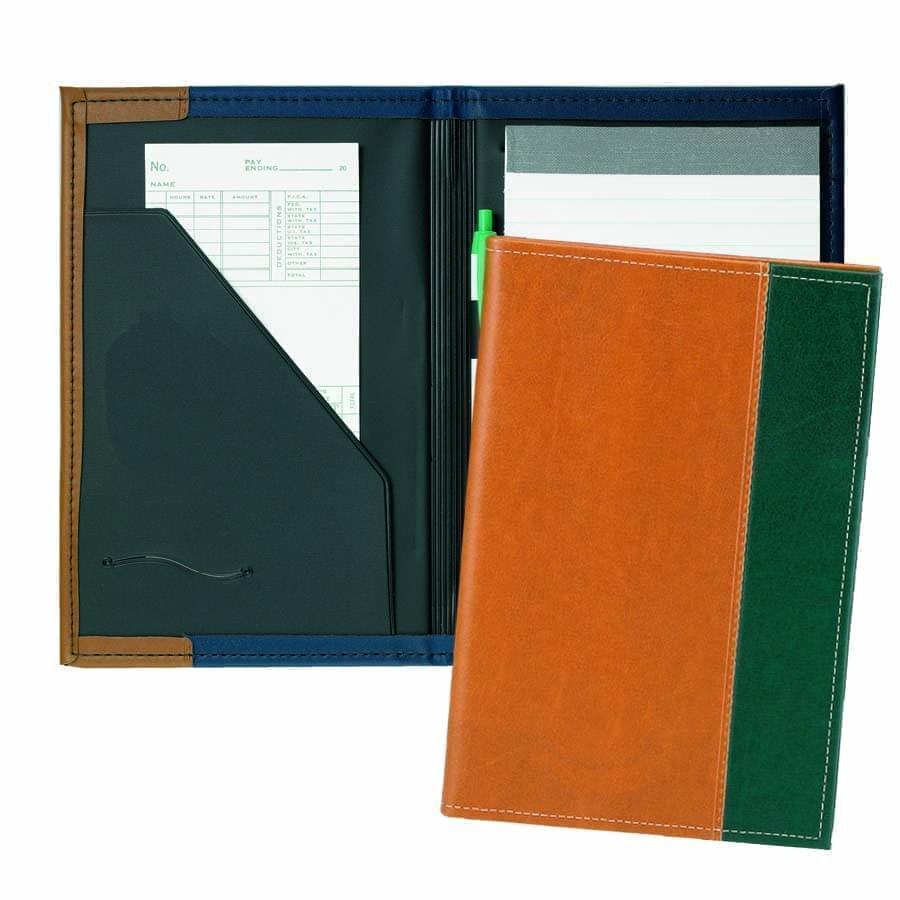

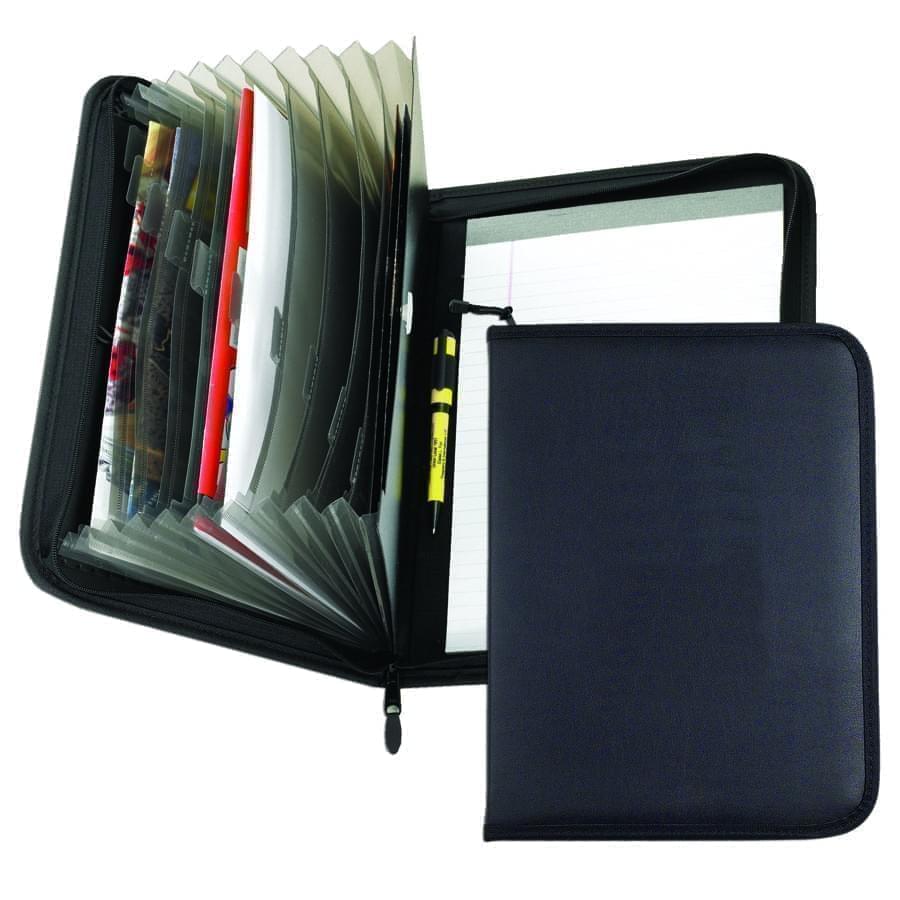

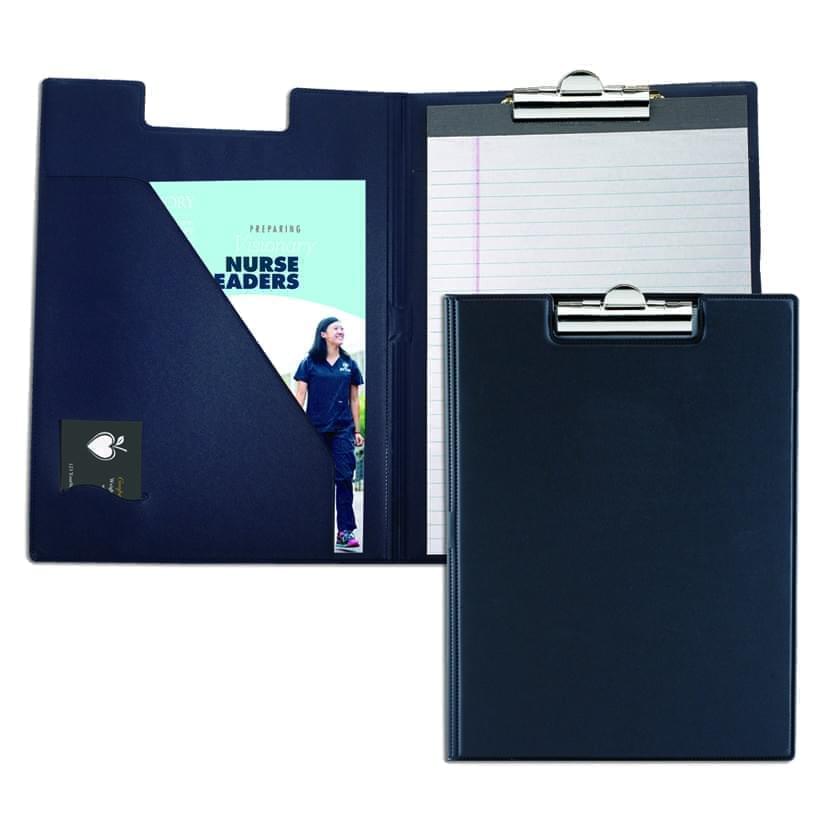

Another area is product selection. So two examples of products that are less expensive to make domestically would be products that are big and bulky to ship and don’t have a lot of labor like this gigantic case right here that we make. That didn’t need to be made in USA but it is.

Or bags using expensive materials– this bag has $40 in leather in it but only maybe $8 in labor. In China maybe you can get it made for $4, so at the end of the day its $48 verses $44. By the time you ship it here and have the duties on it, its less expensive to make it in the United States. That’s why you see a lot of goods with expensive materials made in countries that are more expensive than United States like Italy.

So another area is small batch customization. There is a big overhead to making products overseas, you have to translate, you have to make tech packs. It is expensive to ship sampling back and forth, there are time zone considerations, so as result nobody wants to make 500 or a 1000 of something in China or Bangladesh. It’s a lot less expensive to make it here.

And finally re-engineering is the area where we are able to close the gap through product design. When we get goods a lot of times now people are reshoring goods–they send goods to us and it was a bag that they had made in China, they want to get it made in United States and I’ll say if you want it made exactly this way, its going to cost you $80 because there is no thought given to engineering the products because labor was practically free over there. We can redesign it so your clients won’t notice the difference that will be just as nice and we can do it for $15.

The other area is Lean Manufacturing and that is the concept where you can take people in a high wage environment and train them to use all of their time to just add value to the product and not waste time doing things that are not that the client doesn’t pay for, like looking for a pair of scissors or waiting for manager or walking from machine to machine.

So finally, Newark is a place that is perfect for manufacturing for a number of different reasons. We’ve got a high concentration of skilled labor, we’ve got a well developed infrastructure of manufacturing. There are lot of other manufactures here which means that there is a market for mechanics and trucks and things where that might not exist in an economy where there is not a lot of manufacturers. We are close to the port, we got Newark airport here and we’ve got access to everything. We have access to New York City we have access to capital, marketing, and technological expertise right here in the city of Newark through our academic communities.

There are other cities where this is happening. There are not a lot of rural areas where this is happening. So this is the time to take advantage of this once in a generation opportunity where people are coming to Newark to get things manufactured. Thank you very much.

How To Find Any Cut and Sew Contractor in Minutes

American Success Stories

The All New Chrysler 200

Filmed in Newark, NJ at Unionwear

Chrysler is proud to celebrate the individuals who embody the new spirit of success.

Matthew Burnett: My name is Matthew Burnett and I am the Co-Founder of Maker’s Row.

Tanya Menendez: I am Tanya Menendez, Co-Founder of Maker’s Row. Maker’s Row is an online market place that helps businesses and brands, find American manufacturers.

Matthew Burnett: My background is an industrial design and I used to design watches and I decided to start my own line. I was manufacturing watches overseas for about 3 years and during that time I found that you are really are rolling the dice as a small business owner. I don’t have the time to spend the month oversee the product quality control, but I would just crossing my fingers every time I was ordering something; one time I okayed a sample, 3 months later I get a mass order; it looks nothing like the sample that I approach; so that’s about $40,000 down the drain. Small businesses can take that type of hit.

Tanya Menendez: We’re able to produce smaller batches. We’re able to oversee the production, and they are able to respond to market trends in season. They’re able to produce that in a few weeks and have it to market.

Matthew Burnett: We wanted to create a resource in which be able to find the closest factory with the right pricing or right minimum quantity that you would be able to work with in under a week. It’s almost like a dating site, because there are so many different personality traits that you are looking for to find that perfect match. I think the American dream can evolve to something we’re now people are following their fashion. There are tons of designers, that used to work for large brands and now they are starting their own product-based businesses; because now they have a resource to find these manufactures.

Great background shots in there:

- Unionwear embroidering hats. We embroider hats on the panels before the panels are sewn, for better quality, larger decoration area, and lower cost.

- Our Thread library of over 2000 colors, organized by color, counted for 20 head machines, sorted by number, and kept clean in airtight bags.

- Attaching a visor to a baseball cap.

- Stuffing a visor.

- Sewing the topstitch rows on a visor.

- Attaching a size strip along the perimeter of a baseball cap.

- Closing a tote bag.

- Sewing up the T-bottom on a tote bag.

- Laying up bag fabric to cut 1000 totes.

- Great outside shots of the Unionwear factory.

Newark Video Promotes Local Sourcing

Unionwear is featured in this video for Maker’s Row / Newark, a site for sourcing local cut and sew contractors.

http://www.MakersRow.com/Newark

The video was launched at an event on May 28, when Unionwear CEO Mitch Cahn spoke at a Brookings Institution panel along with Mayor Cory Booker and NJIT President Joel Bloom on Newark’s Manufacturing Moment, discussed here in NJ Biz Magazine:

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

Zipper Folders

Zipper Folders

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

Clipboards

Clipboards

Union Made In USA

Union Made In USA