According to the Wall Street Journal, the US is ironically poised to be a big winner due to Europe’s energy crisis.

Skyrocketing gas prices in Europe is forcing European manufacturers of steel, fertilizer and other feedstocks of economic activity to shift operations to the US. These firms are attracted by more stable energy prices and muscular government support, including a raft of incentives for manufacturing and green energy. Also, new spending by Washington on infrastructure, microchips and green-energy projects has heightened the U.S.’s business appeal.

“It’s a no-brainer to go and do that in the United States,” said Ahmed El-Hoshy, chief executive of Amsterdam-based chemical firm OCI NV, which this month announced an expansion of an ammonia plant in Texas.

Despite inflation and other Covid-related supply chain problems, the US has emerged relatively strong from the pandemic, especially as China continues to enforce Covid lockdowns and Europe is destabilized by war.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

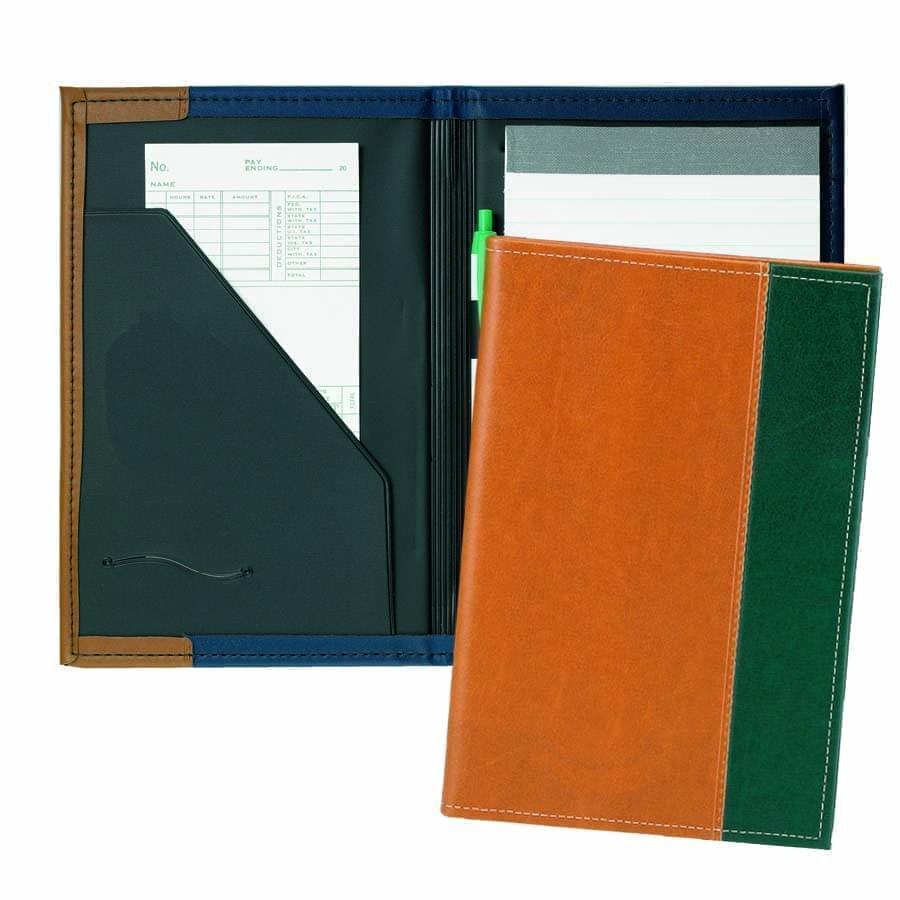

Zipper Folders

Zipper Folders

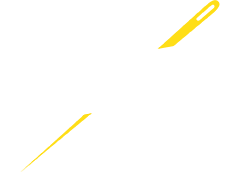

Stitched Folders

Stitched Folders

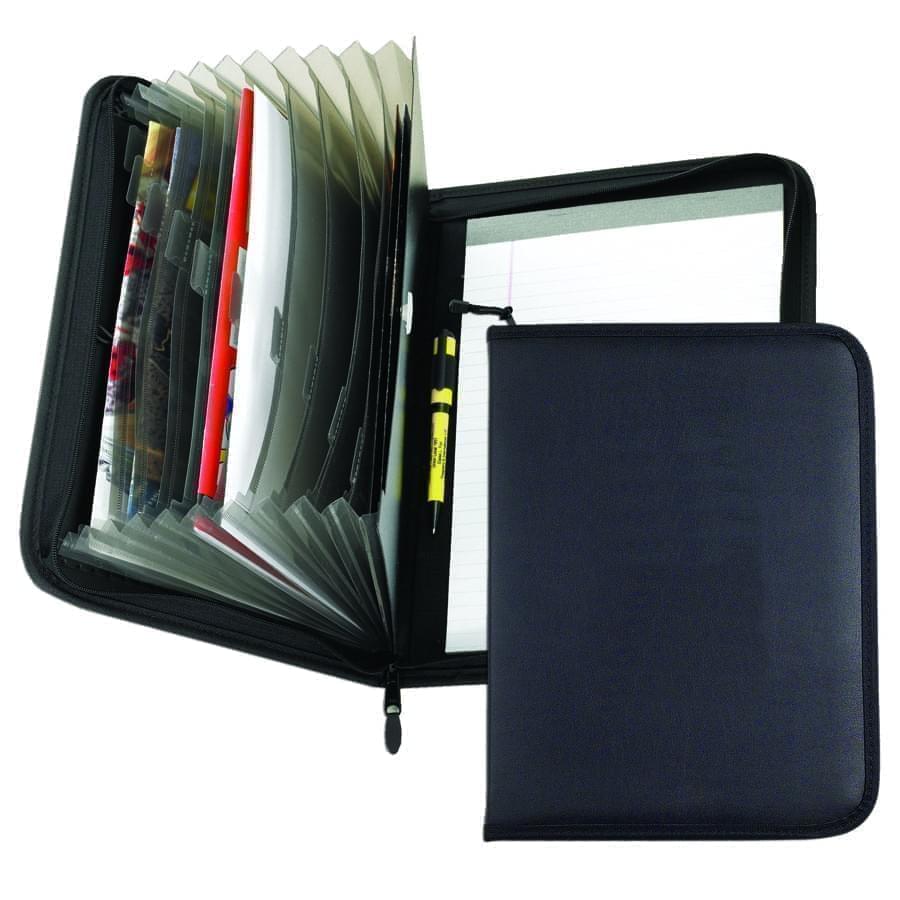

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

Clipboards

Clipboards

Union Made In USA

Union Made In USA