The Wall Street Journal reported yesterday that Unionwear, a New Jersey manufacturer of hats and bags, has had its repayment plan approved by Judge John Sherwood, and will emerge from a Federal court supervised restructuring it filed earlier this year to cut down on union pension related debt.

President Mitch Cahn will retain control of the business after a capital contribution by Reshoring Capital was approved. Operations will be spun off into a wholly owned subsidiary, USA Made Brands.

Said Cahn, “Everyone here is elated. We weren’t sure our company would emerge intact, and never thought our sales would end up exceeding our record year in 2016, when we were a primary supplier of USA Made baseball caps and tote bags to nearly every presidential candidate. In the past, sales would always dip the year after an election. But our sales have grown by 35% since the filing.”

Prior to the Chapter 11 Unionwear was unable to borrow from traditional sources to expand due to the withdrawal liability created by the failure of its union’s pension fund.

“The withdrawal liability was completely out of our control so I was not willing to invest personal funds or take insider funds until we could at least contain the problem. Once we were able to exit the National Retirement Fund we could at least stop the withdrawal liability from growing. Reshoring Capital was willing and able to provide us the DIP financing to carry us through the chapter 11 and provide exit financing, and I was able invest personal funds in several things necessary to scale.”

These investments include:

- Two entire new lines of business – we are now making leather portfolio folders and binders as well as knit hats and scarves.

- New equipment made available as other textile businesses close, which seems to have spiked again this year as the NYC and LA sew shops have been hurt by wage and rent costs.

- New management personnel-a plant manager from coach with 20 years of experience in lean manufacturing

Cahn says 2017 will be the best year in Unionwear’s 25 year history and that Unionwear is opening 2018 with a tremendous backlog of business.

“Our balance sheet is much stronger as is our team and the excitement here is translating into sales and productivity. The restructuring forced us to be smarter than we’ve ever had to be with our cash flow. It forced us to successfully implement just in time inventory management and an MRP system.

Additionally We’ve been able to finance this growth without adding new debt and We have been able to manage the growth despite the burdensome regulatory requirements a restructuring imposes on small businesses. It was a year long distraction that is now behind us and we are positioned well to capitalize on the growth in interest in USA Made.”

As part of the restructuring, Unionwear’s employees moved from a failed defined benefit plan from which they would be unable to collect to a defined contribution plan with a match.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

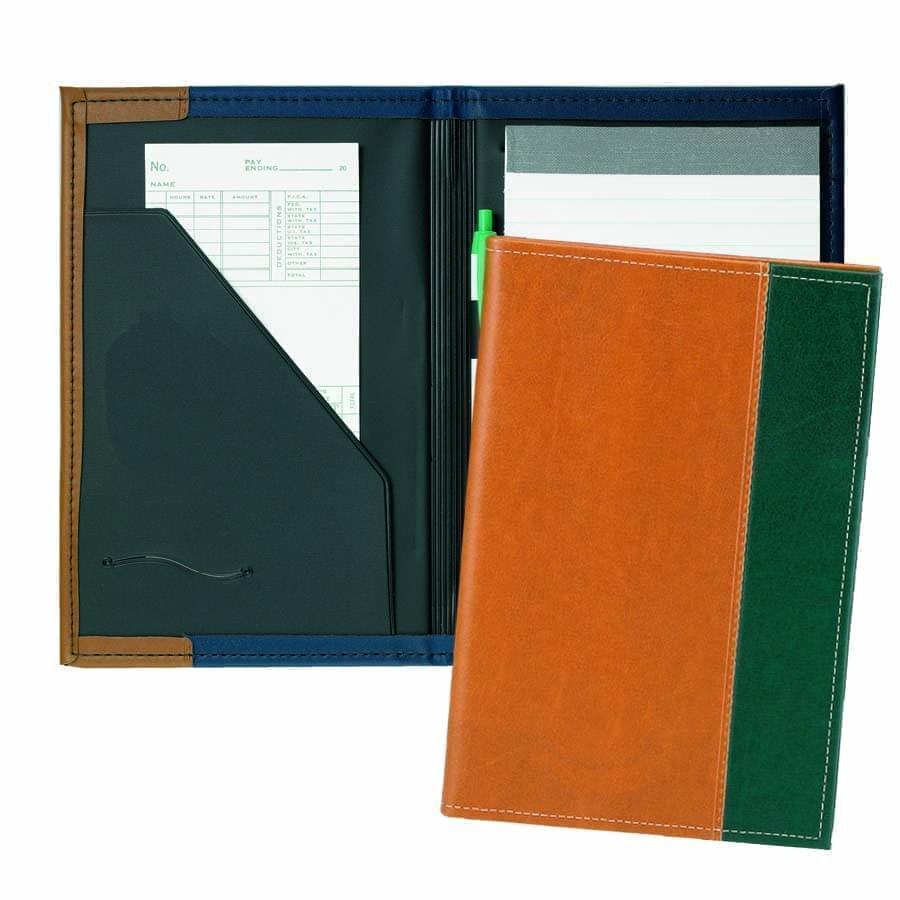

Zipper Folders

Zipper Folders

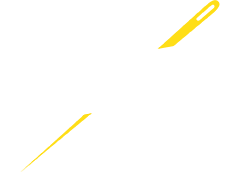

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

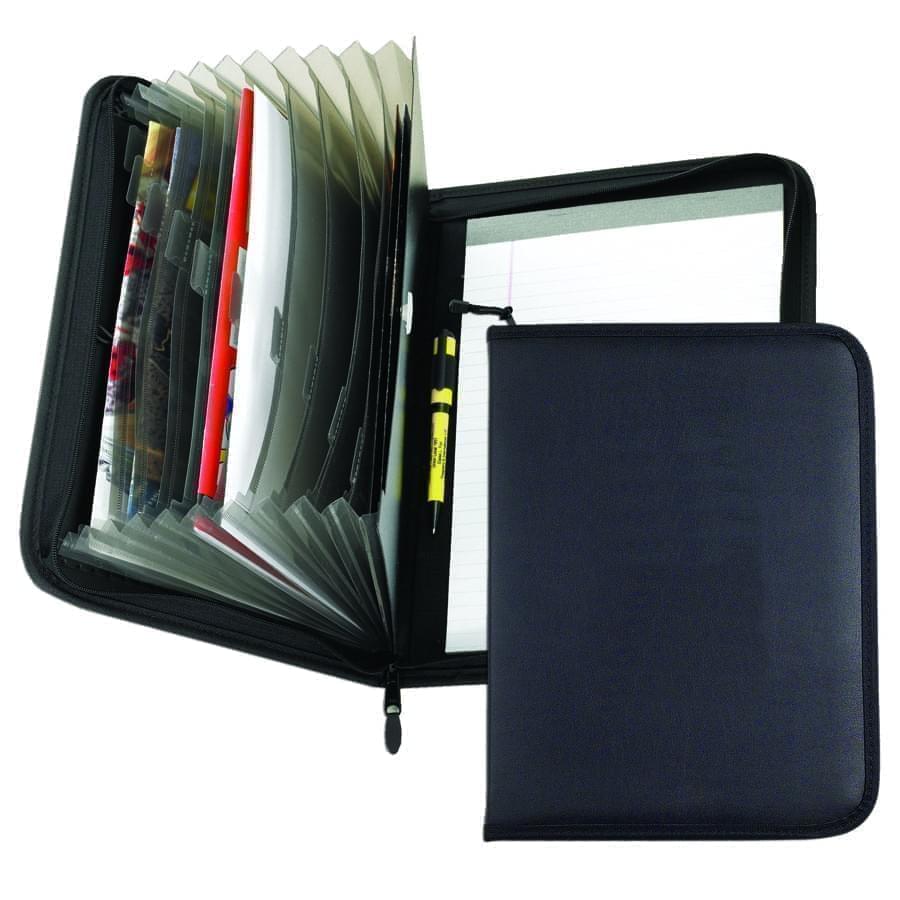

Clipboards

Clipboards

Union Made In USA

Union Made In USA