Thomas / Xometry explains what they believe will be the top trends in the supply chain for 2023.

1. There will be an increase in reshoring and near-sourcing

High freight costs, labor shortages, and factory shutdowns, transportation delays, and geopolitical conflicts, have compelled many organizations to rethink their approach to supply chain management. Reshoring manufacturing back to the USA is the best option in our opinion. But nearshoring might also be beneficial and practical for the supply chain. In fact, Fortune says 2023 could be “a nearshoring jackpot for the Americas.”

2. Product-as-a-Service

Product-as-a-service (PaaS) sees vendors combine physical products and services to better fulfill customer needs. For example, equipment manufacturers may lease specialized machinery with a subscription.

3. Crowdsourced Delivery

Last-mile delivery is proving particularly challenging, thanks to high warehousing costs, inefficient routes, lack of visibility, and transportation delays. Retailers began experimenting with crowdsourced delivery, where they leverage networks of local couriers. This approach could revolutionize same-day shipping. Think of it like Uber for packages.

4. Better Worker Conditions for Truckers

The U.S. was short almost 78,000 truck drivers in 2022. The shortfall can be attributed to including increased demand, a retiring workforce, and fewer younger drivers entering the industry. It also could be due to bad pay, a trend which seems to be shifing. In 2023, companies will likely implement referral bonuses and tenure pay to better retain their drivers. As well, it says in 2023, safety will be incentivized over productivity,

5. High Supply Chain Costs

Between January and June, for example, the price of regular motor gasoline rose by 49% in 2022 and the price of diesel fuel rose by 55%. Meanwhile, the ongoing war in Ukraine has seen a decline in food supplies and transportation bottlenecks.

In December, U.S. Treasury Secretary Janet Yellen forecast that in 2023 inflation will be “much lower.” However, it came with the caveat that this is barring “an unanticipated shock.” In 2023 “key commodity prices and availability may fluctuate.”

6. Smaller Warehouses

Retailers might look to transform existing retail spaces into fulfillment centers, a tactic taken by Walmart, which is in the process of converting many of its 4,700 stores to mini-warehouses.

Another key trend in warehousing is that the vast majority of spaces are at capacity, with industrial warehouse vacancies sitting at around 1% (as of September 2021). Demand has gotten so high that some tenants are opting to lease space before it is actually required. It’s projected that another 400 million square feet will be needed by the end of 2025 to meet demand at current growth rates. So, turning workplaces into warehouses might happen sooner rather than later.

7. Major Skills Gaps Remain

A shortage of laborers, including truckers, is driving up wages and, ultimately, consumer prices. It’s also impacting recruitment. In fact, one in five people were likely to switch jobs in the next 12 months, and it’s projected that there will be more than two million manufacturing roles left vacant by 2030. As such, firms will need to do much more to upskill and retain their workforce.

8. Technology Investments

61% of supply chain leaders said technology is a source of competitive advantage. Meanwhile, 34% of supply chain leaders noted that adapting to innovative technology will be the most critical strategic change in the future. The top supply chain technology trends of 2022 included digital twins, autonomous things, sustainability tools, and analytics everywhere.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

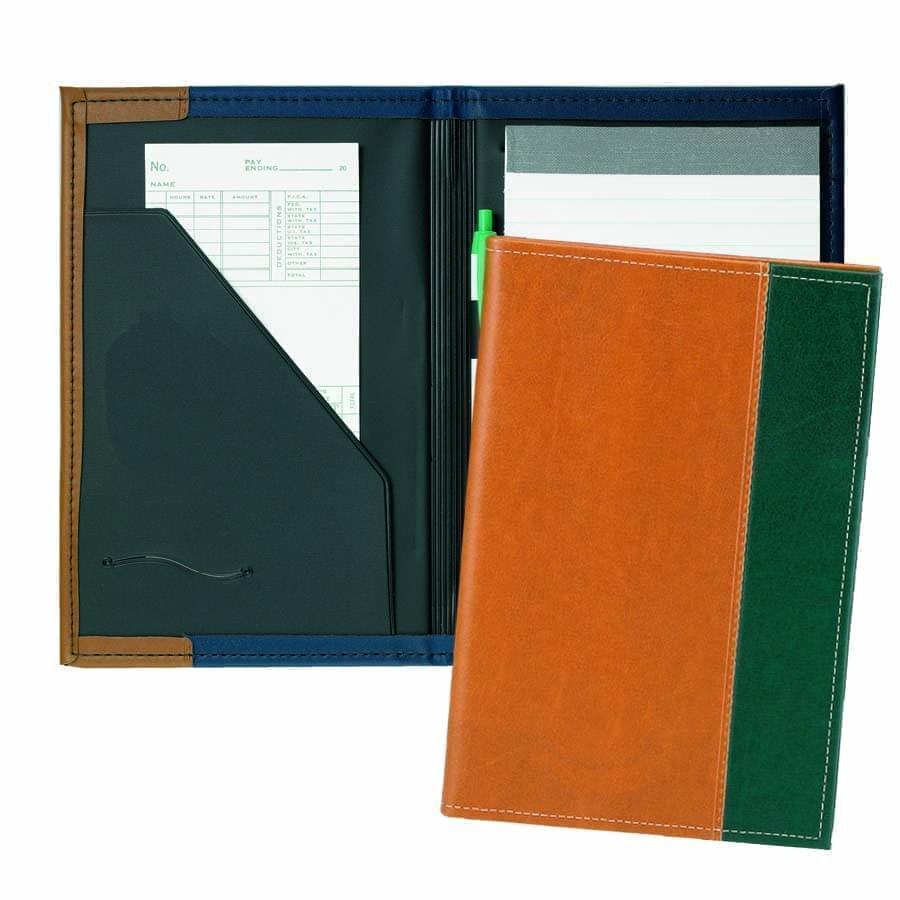

Zipper Folders

Zipper Folders

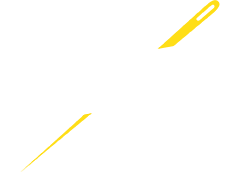

Stitched Folders

Stitched Folders

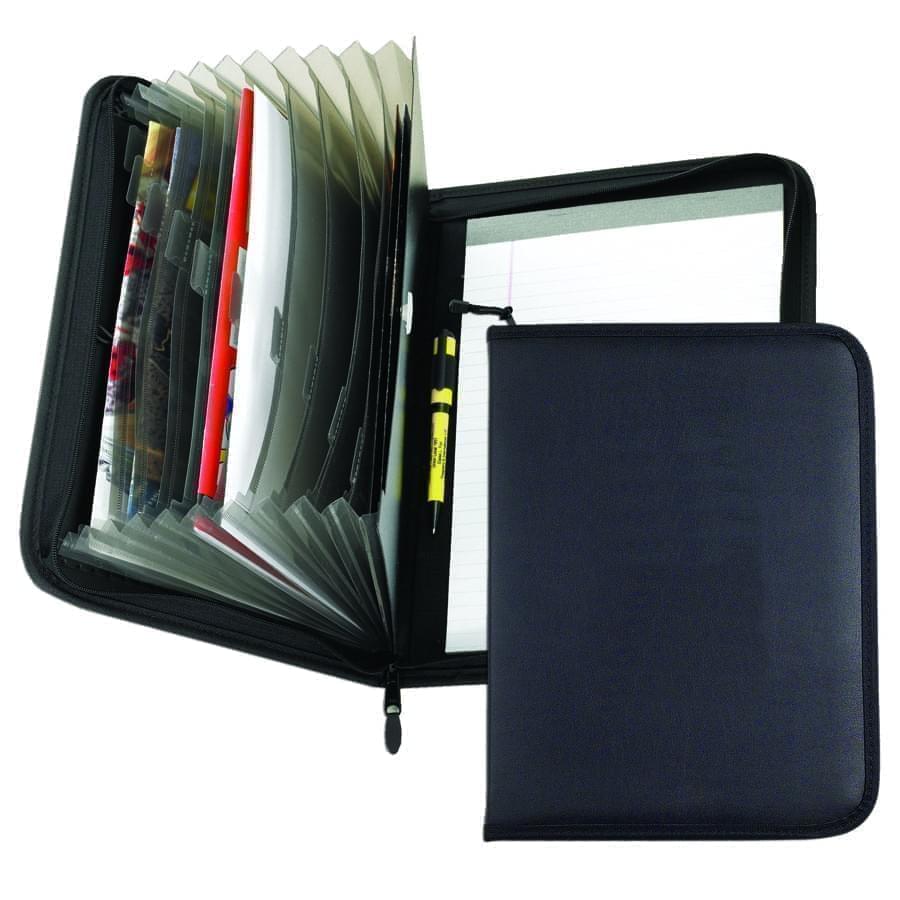

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

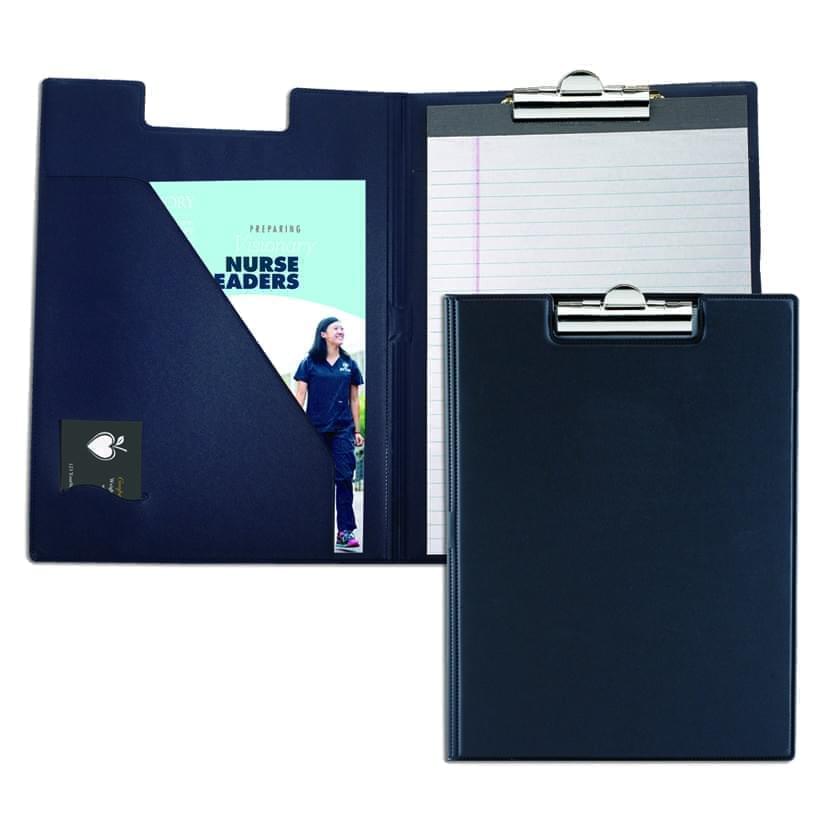

Clipboards

Clipboards

Union Made In USA

Union Made In USA