An article at Mondaq.com goes into some detail about the many opportunities presented by the recently passed Inflation Reduction Act (IRA).

Among other things, the Act saw the introduction of a number of new and expanded tax credits aimed at onshoring American manufacturing, representing opportunities for manufacturing within critical industries, in particular those industries that are key players in the Biden administration’s goal to address climate change. The incentives range from tax credits directly to manufacturers of certain equipment to incentives for taxpayers to purchase equipment from American manufacturers.

Many of the tax credits will go into effect on January 1, 2023. Treasury and the White House have stated that they will work with industry to ensure that the regulations have a broad consensus and can benefit both large and small manufacturers. Credits are available on an annual basis for eligible components sold beginning in 2023, going through 2032 (with a phaseout beginning in 2030).

One example: a new production tax credit was introduced with the IRA. Eligible components include components within wind, solar, and battery projects, such as PV cells, PV wafers, solar modules, blades, nacelles, inverters, and battery cells and modules, among many others.

The IRA also expanded a tax credit that provides incentives for solar manufacturers, among other clean energy producers, for purchasing and commissioning property to build a manufacturing facility before January 1, 2025.

For taxpayers that don’t have the tax appetite to claim the credits on their returns directly, the IRA enacted two new provisions that may help taxpayers take advantage of these credits. Manufacturers can receive a direct cash payment from Treasury for the first five years for which the manufacturer would otherwise have been eligible for the credit.

There’s a lot more detail in the article here. Have a read.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

Zipper Folders

Zipper Folders

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

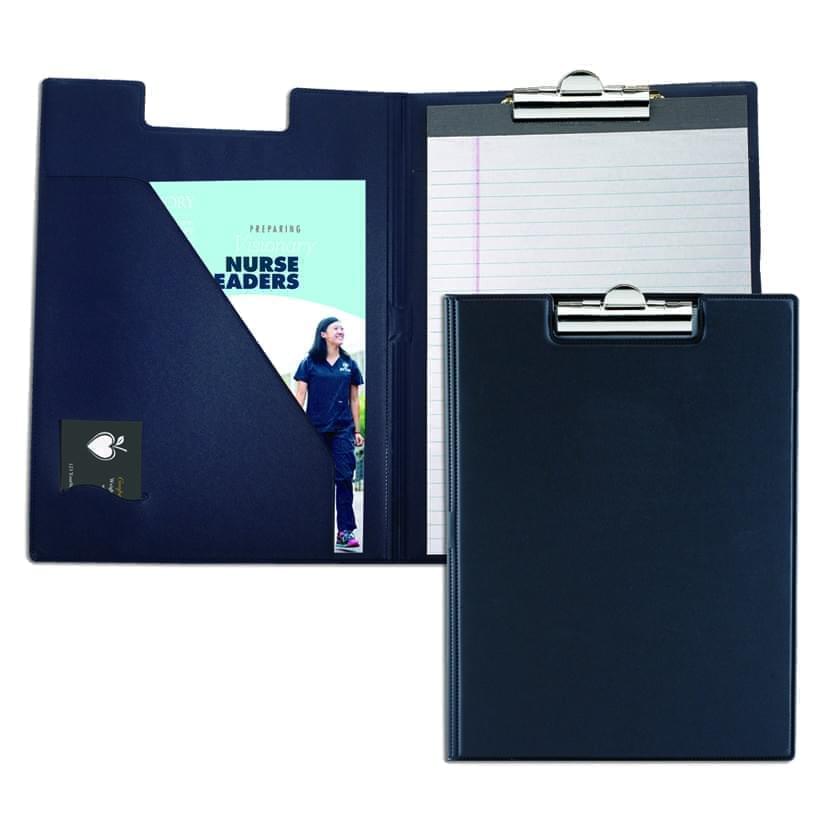

Clipboards

Clipboards

Union Made In USA

Union Made In USA