Yahoo News reports that New York Sen. Kirsten Gillibrand introduced the pro-labor federal ‘‘Fashioning Accountability and Building Real Institutional Change (FABRIC) Act.’’

The bill tackles reshoring tax incentives, the piece-rate pay system, joint liability and more in one fell swoop.

Among the features in store, the bill would create a $40 million domestic garment manufacturing support program with incentives like a 30 percent tax credit for reshoring garment manufacturing as well as a handsome grant program included in the package.

The bill would extend protections under the Fair Labor Standards Act of 1938 to prohibit employers from paying employees in the garment industry by piece rate (guaranteeing minimum wage as the floor to build upon incentives) — a loophole Gov. Gavin Newsom closed in California by signing the Garment Worker Protection Act, or SB 62, into law last year after a crusade by the GWC.

In its current draft, manufacturers and contractors in the garment industry would also be required to register with the Department of Labor. Registration fees to the Labor Department will help stoke the revitalization of the domestic manufacturing landscape. Meanwhile, manufacturer information gathered will aid recordkeeping and transparency measures.

“The bill is quite simple. It just mandates a fair work environment and fair worker treatment, and it authorizes some resources to do this,” said Gillibrand. “The combination of that investment plus the fact that it’s asking for broader, better treatment of workers [is] a combination that has appeal, and so we’re going to ask for a vote between now and end of the year.”

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

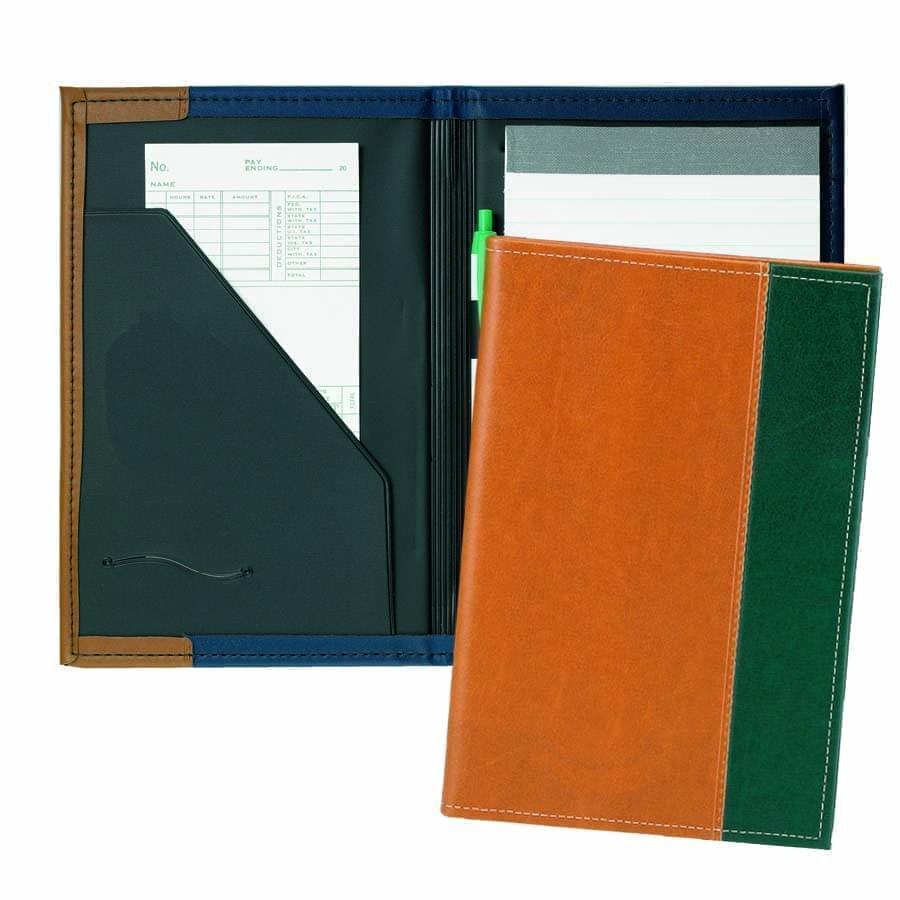

Zipper Folders

Zipper Folders

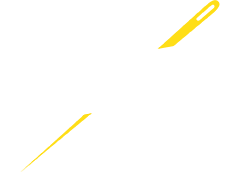

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

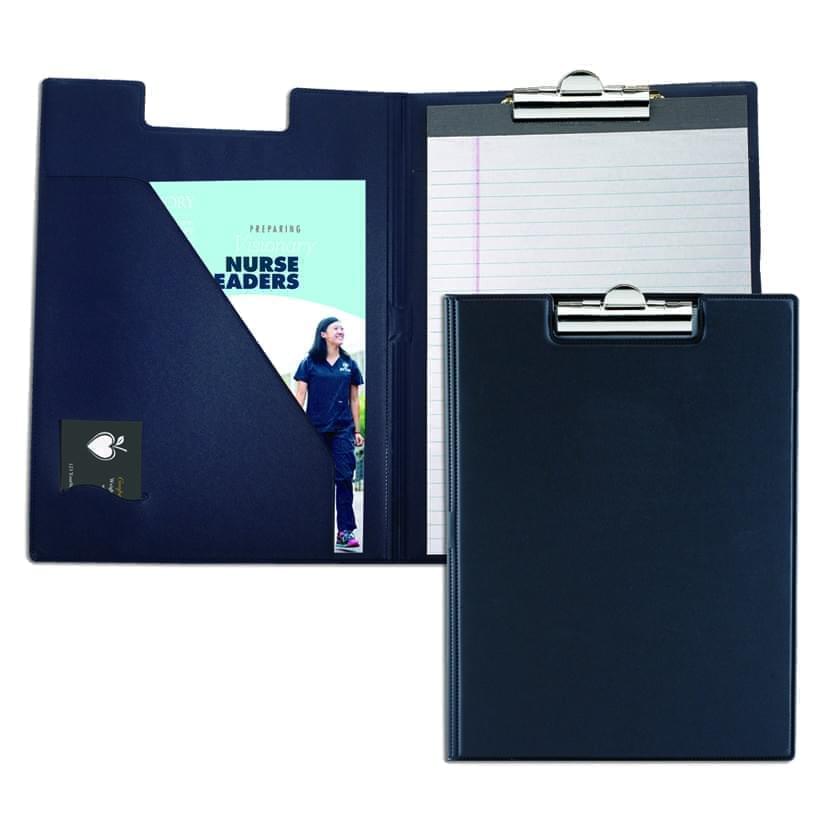

Clipboards

Clipboards

Union Made In USA

Union Made In USA