US Treasury Secretary Janet Yellen provided further details into the Biden administration’s ambitious corporate tax plans, which are expected to increase government revenue, and help pay for the administration’s proposed $2.25 infrastructure package.

Yellen provided additional insight into “The Made in America Tax Plan,” which is supposed to remove incentives for companies to move profits overseas, increase government tax revenue to help fund critical social problems, as well as increase fairness to all Americans. If the plan materializes, it would reportedly generate upwards of $2.5 trillion in revenue over a span of 15 years.

However, the tax plan also means that American companies would no longer be able to benefit from the numerous quirks embedded in the tax code, which allowed for reduced tax liabilities by shifting profits overseas. The tax plan would also address climate change, by substituting fossil fuel subsidies with clean energy production tax incentives.

Read more HERE

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

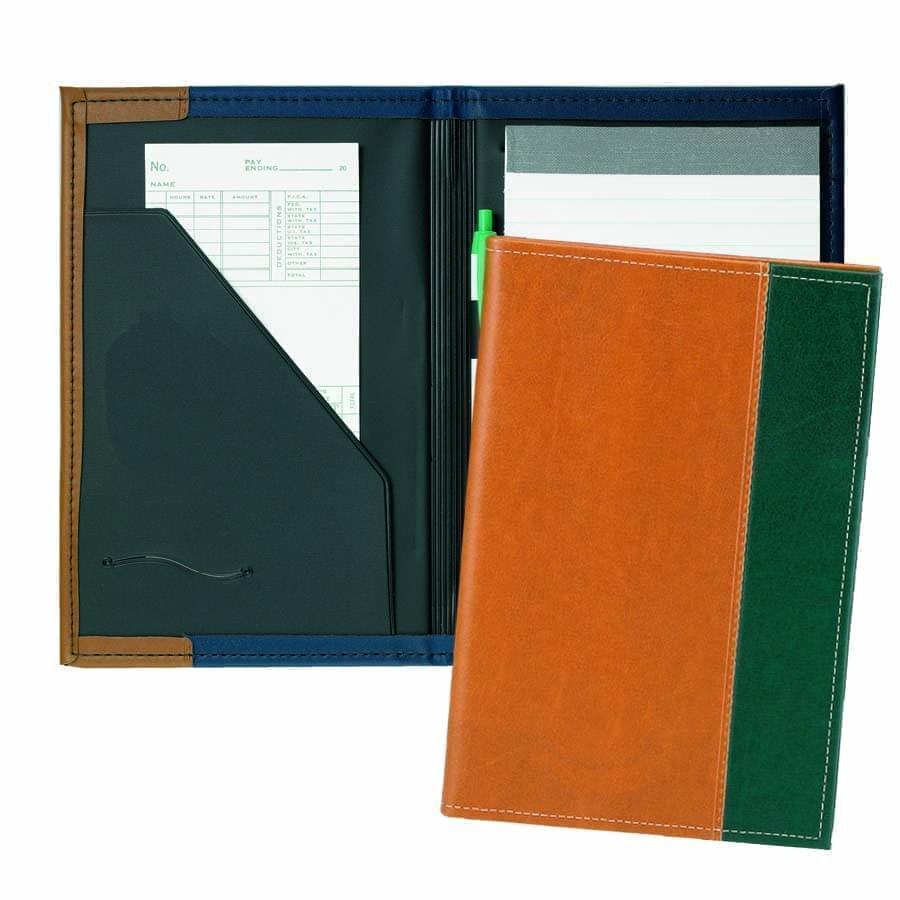

Zipper Folders

Zipper Folders

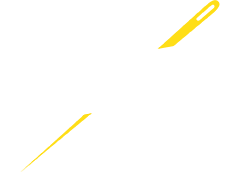

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

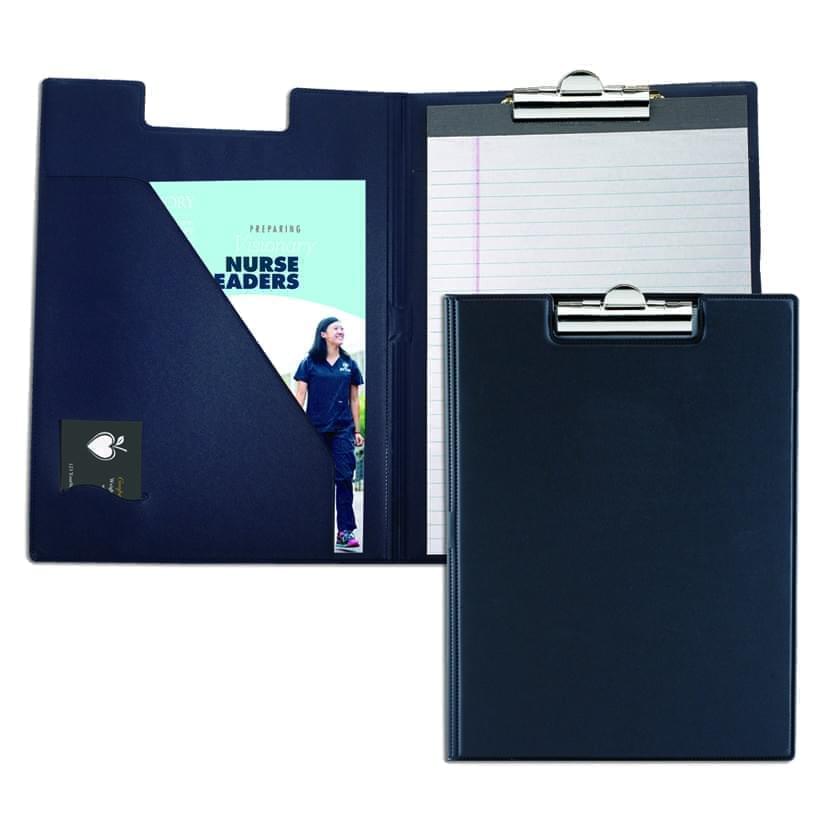

Clipboards

Clipboards

Union Made In USA

Union Made In USA