A few years ago Adweek wrote an article explaining that made in America is no longer a pipe dream but is slowly becoming a reality. American factory jobs grew to 12.3 million by 2016. And, according to the nonprofit Reshoring Initiative, no fewer than 576,000 factory jobs have returned to America since 2010.

While carrying the made in USA label is a feel-good move for many consumers, businesses are wondering what it means for the bottom-line. Because it might feel good to say your products are made in America, that isn’t the main driver for the return of American manufacturing. It almost certainly doesn’t change buying habits.

Why are companies reshoring now? The reasons are varied and complex, ranging from growing labor costs in Asian countries to quality control. Rarely is the branding opportunity a factor. For better or worse, unless someone has a very strong incentive to buy made in USA products (such as political candidates or government contractors) where a product is manufactured rarely factors into a purchasing decision.

Bayard Winthrop, founder of American Giant, a brand that manufactures hoodies in North Carolina, says geographic proximity is what matters most. “There’s a huge benefit to being able to hop on a plane and talk to the people who are spinning my yarn and weaving my cloth,” says Winthrop, who’s based in San Francisco. Winthrop says Made in America marketing is an add-on, not a reason people buy. “I don’t believe consumers are willing to pay at the cash register for [American-made] things—I really don’t,” he says. “What consumers are willing to pay for is great brands and great quality.”

According to the Adweek article, the vast majority of people are not going to pay a much higher price for made in America. One of the main reasons they make everything domestically is quality control. Indeed, according to David Hamilton, fourth-generation owner of Hamilton Shirts, domestic manufacturing is essential for quality control. Hamilton’s shirts start at $265, and many of them are made to order. Production of a luxury product like that cannot be trusted to something being made halfway around the world. “If I’m on the phone with a customer [who has an issue],” he says, “I can walk into the factory and research the problem and resolve it.”

The same thing goes for large brands. 3M’s Post-it barely mentions that their sticky notes have been made in Kentucky for the last 33 years. Why? Distribution. An American plant is both closer to pulp suppliers and to retailers. “It’s a shorter supply chain,” explains global business manager Adrienne Hovland. Made in America is “not one of those key messages we use,” she says. “We have a lot of other things that are compelling to communicate.”

It’s worth noting that the Adweek article was written before the Covid-19 pandemic disrupted global supply chains. I imagine we will see major reshoring in the coming years because of the issues described in this article as well as government mandates. But companies will not reshore manufacturing to enhance their branding, even though that might be an added benefit.

At the end of the day, made in America isn’t a huge driver for reshoring manufacturing. Quality control, supply chain management and holding people accountable for customer service challenges are major reasons for bringing jobs back home.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

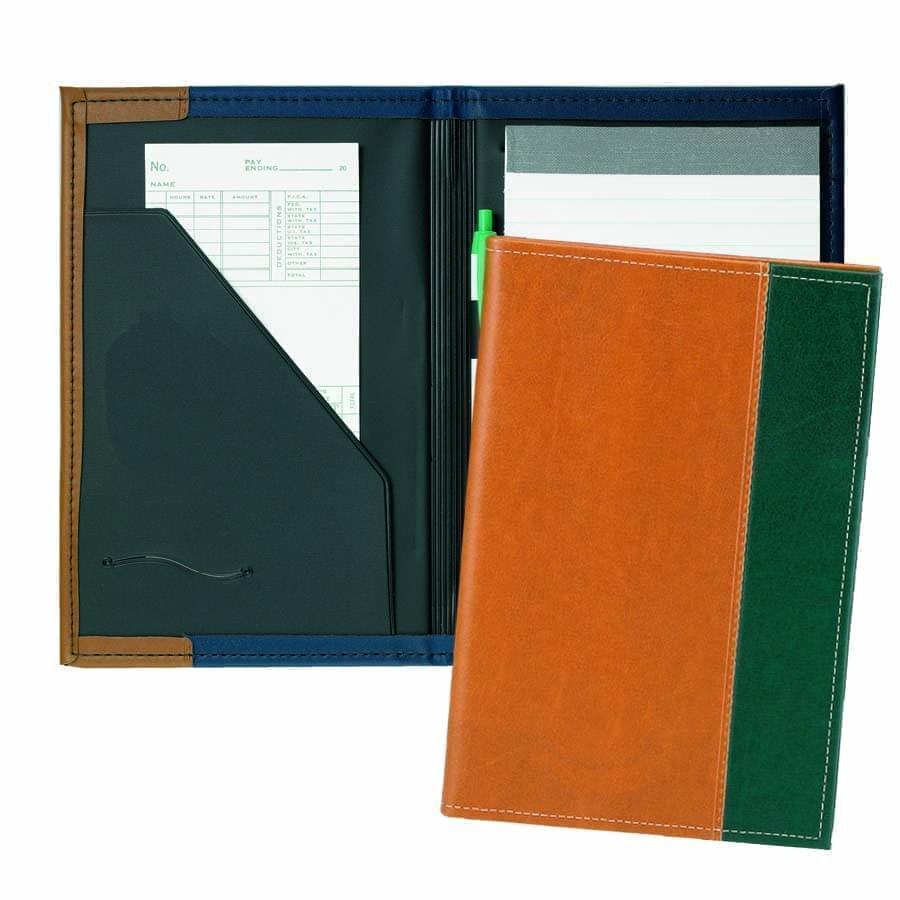

Zipper Folders

Zipper Folders

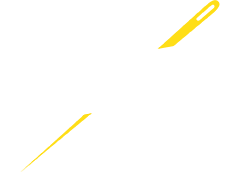

Stitched Folders

Stitched Folders

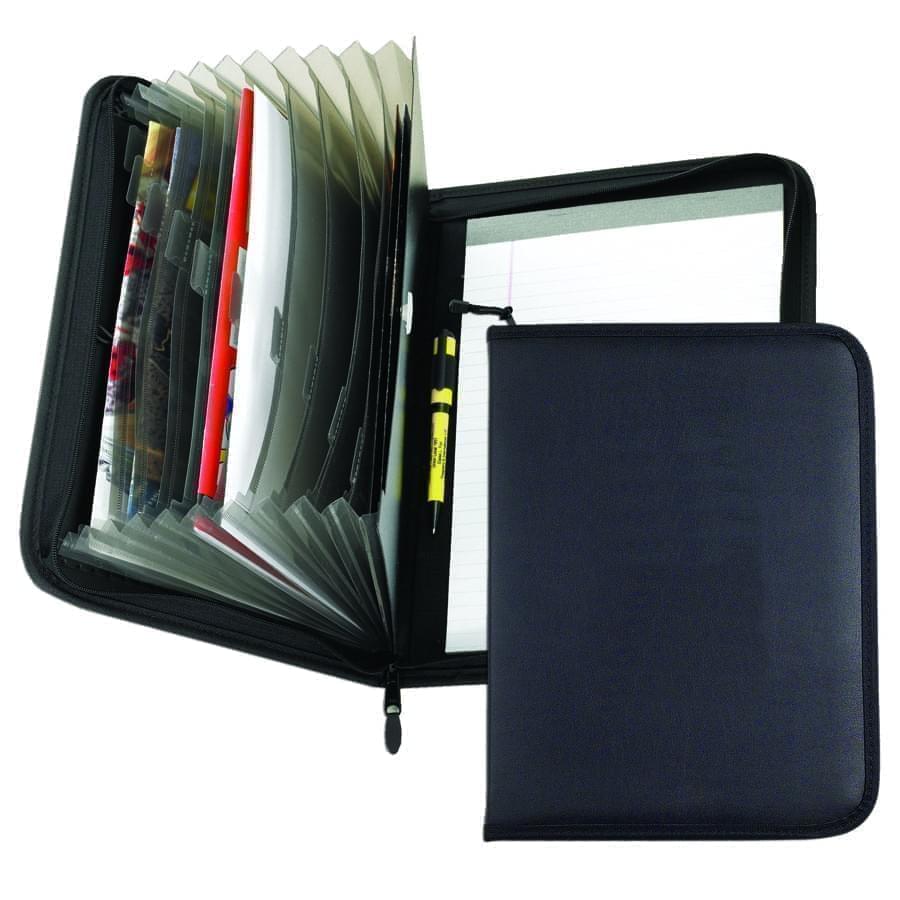

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

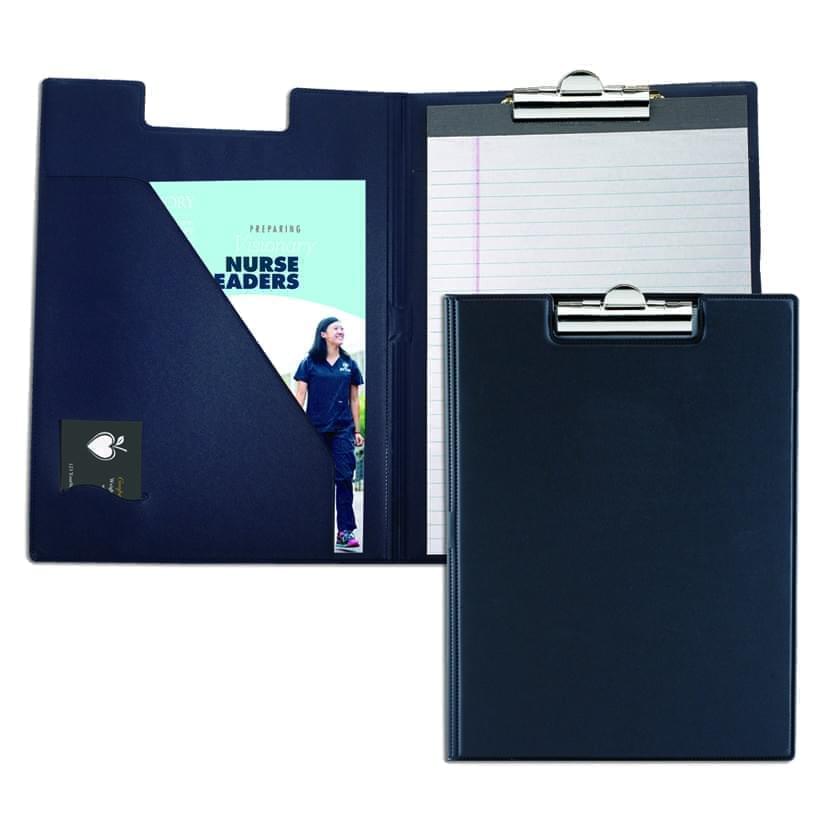

Clipboards

Clipboards

Union Made In USA

Union Made In USA