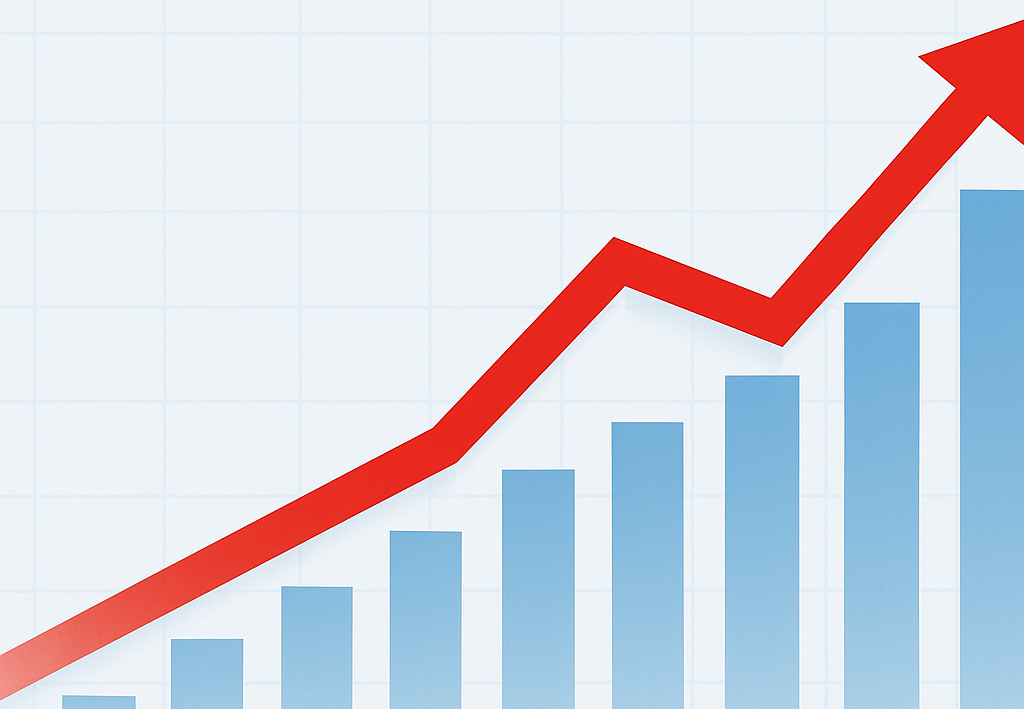

In July 2025, the U.S. Producer Price Index (PPI) rose sharply by 0.9%, its largest monthly jump in three years, outpacing forecasts and signaling renewed inflationary pressures in manufacturing and wholesale costs. Year‑over‑year, the PPI climbed 3.3%, the strongest annual gain since February. Key drivers included rising service-sector costs—especially in machinery wholesaling, trade margins, and portfolio management—as well as soaring commodity prices, like vegetables and diesel fuel.

Despite these wholesale pressures, consumer-level inflation (CPI) remained comparatively stable, offering some relief to cost-sensitive industries. Still, the gap between rising producer costs and steadier consumer prices puts businesses in a bind: they must either absorb costs or pass them to shoppers—risking thinner margins or lower demand.

Unionwear stands out as a resilient leader amid this inflation surge. By leveraging strategic supplier partnerships, optimizing domestic production, and streamlining logistics, UnionWear has successfully mitigated input-cost shocks. Their proactive strategy allows them to protect margins without compromising product quality or price competitiveness.

Looking ahead, Unionwear is uniquely positioned to benefit from reshoring and domestic sourcing trends. As tariffs and global supply-chain volatility continue to push up manufacturing costs, Unionwear’s investment in domestic production offers supply reliability, cost control, and brand resilience.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

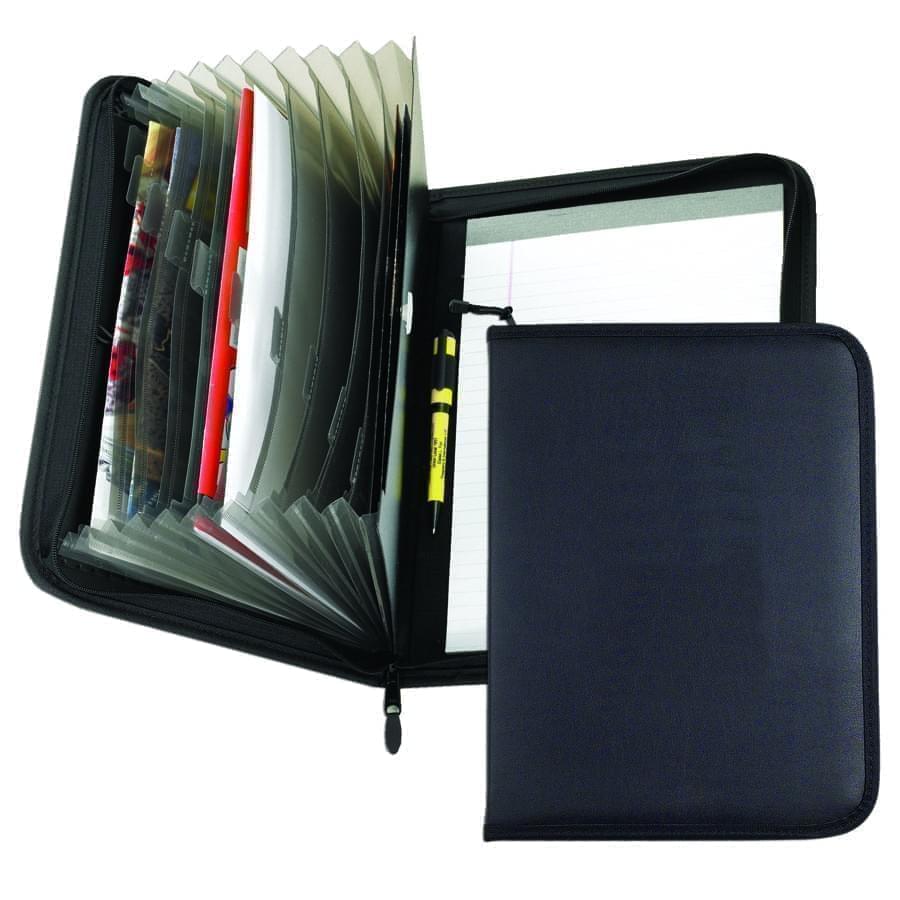

Zipper Folders

Zipper Folders

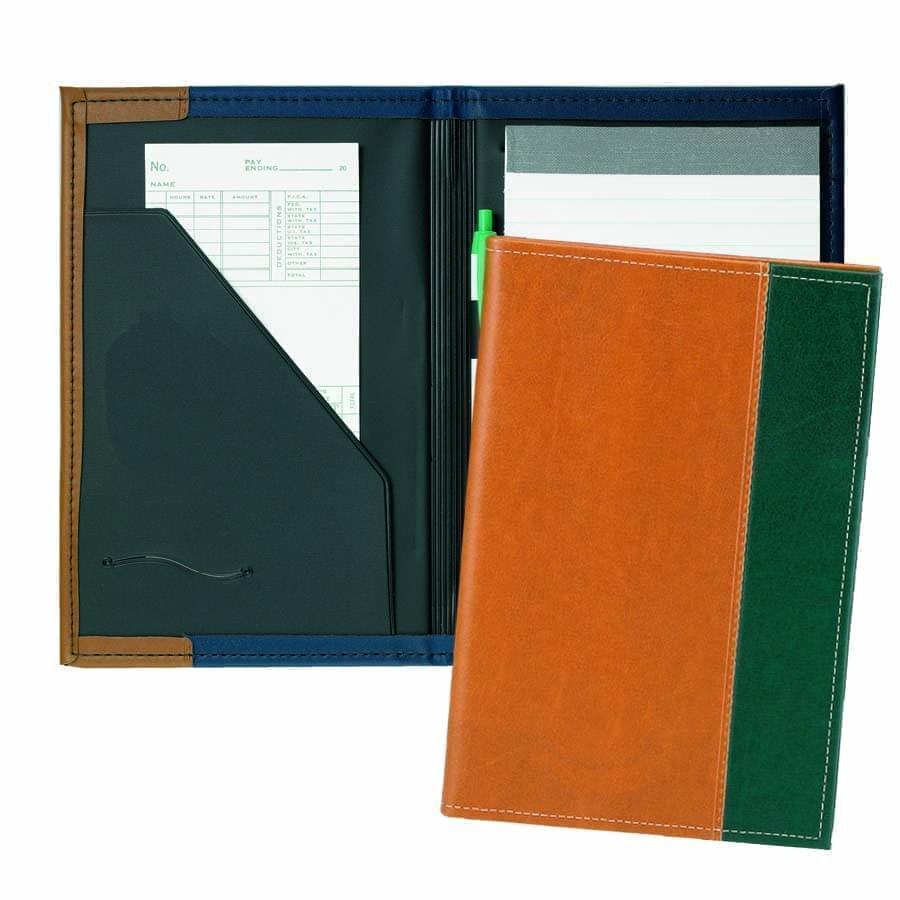

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

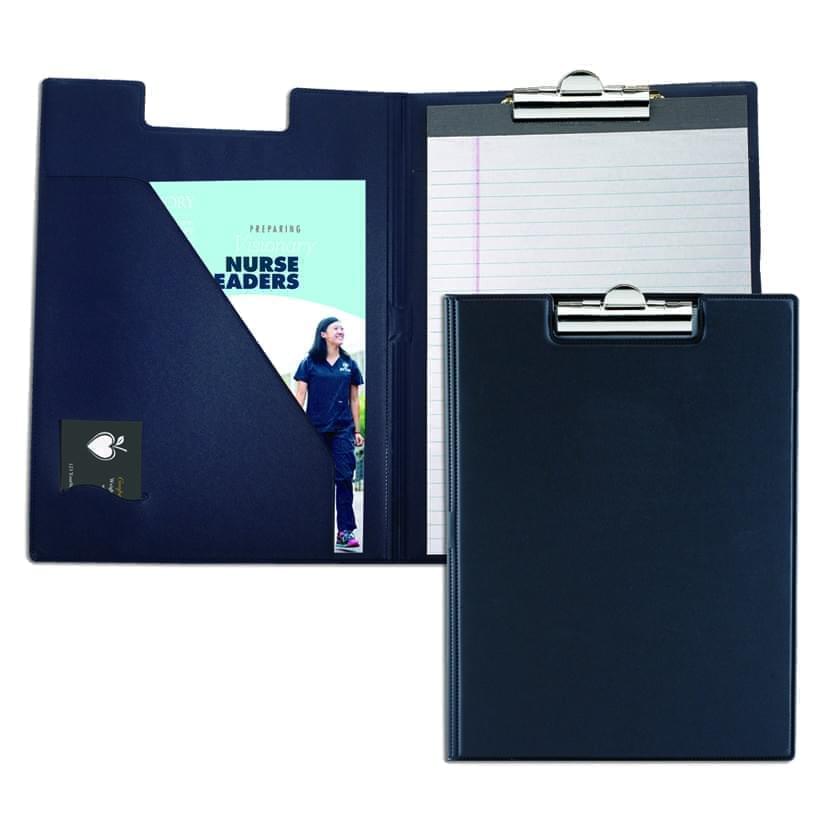

Clipboards

Clipboards

Union Made In USA

Union Made In USA