Fast Company shares some ideas on how the US can make EVs without China, but it won’t be easy.

China currently controls 60% of the world’s lithium mining, 77% of battery cell capacity, and 60% of battery component manufacturing. Many American EV makers, including Tesla, rely heavily on battery materials from China.

How did China dominate the market? Through an aggressive mix of carrots and sticks. Its consumer subsidies raised demand at home, and Beijing and other major cities set licensing quotas mandating a minimum share of EV sales. China also established a world-dominating battery supply chain by securing overseas mineral supplies and heavily subsidizing its battery manufacturers.

In the short term, the US needs to rely on strategic partners overseas. The recently passed Inflation Reduction Act allows imports of critical minerals from countries with free trade agreements to qualify for incentives, but not imports of battery components. This means suppliers like Korea’s LG Chem, SK Innovation, and Samsung SDI, which supply 26% of the world’s EV batteries, are shut out. In the spirit of friendshoring — that is, reshoring manufacturing to allies and key partners, the Biden administration could issue a temporary waiver that makes it easier for Korean battery makers to move more of their supply chain to the U.S.

In the mid- to long-term, a concerted trade and diplomacy effort will be necessary for the U.S. to secure critical mineral supplies. The Democratic Republic of the Congo, where 70% of the world’s cobalt is mined, and Chinese companies control 80% of those supplies. To counter this, the Biden administration’s “friendshoring” vision has a chance only if it can diversify the lithium and cobalt supply chains.

There’s more at the article here. Have a look.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

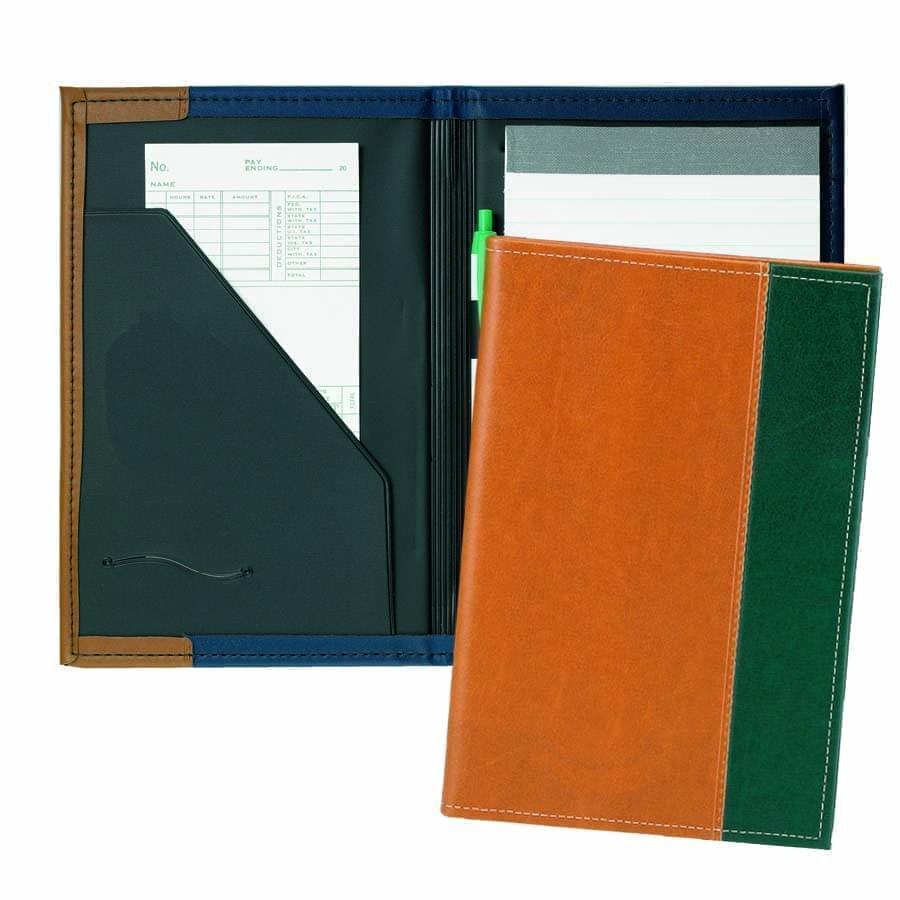

Zipper Folders

Zipper Folders

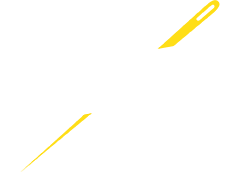

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

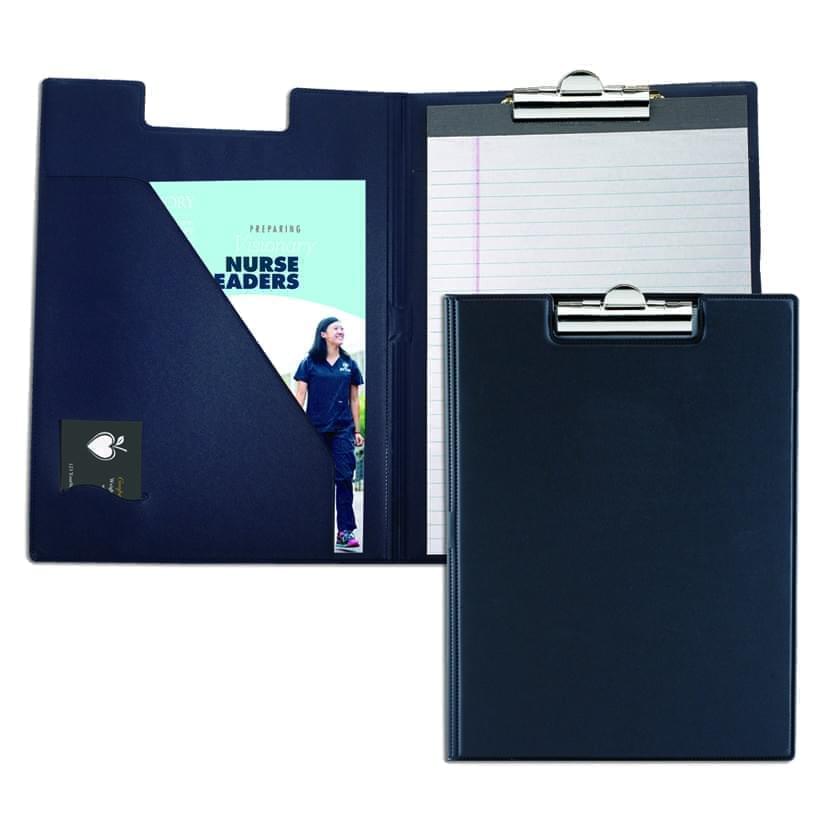

Clipboards

Clipboards

Union Made In USA

Union Made In USA