The latest Bloomberg analysis shows US executives have been saying onshoring, reshoring or nearshoring at a greater rate this year than during the first six months of the pandemic, according to earnings call and conference presentations Bloomberg reviewed. There are concrete signs that many of them are going beyond just talk and acting on these plans.

New manufacturing soared 116% over the past year, dwarfing the 10% gain on all building projects combined, according to Dodge Construction Network. Massive chip factories are going up in Phoenix; Intel is building two just outside the city. And aluminum and steel plants that are being erected across the south, including in Bay Minette, Alabama; Osceola, Arkansas; and in Brandenburg, Kentucky.

Near Buffalo, New York, new semiconductor and steel output is fueling orders for air compressors that will be cranked out at an Ingersoll Rand plant that had been shuttered for years.

Scores of smaller companies are making similar moves, according to Richard Branch, the chief economist at Dodge. Granted, some new construction is to expand capacity.

But they all point to the same thing — a major re-assessment of supply chains in the wake of port bottlenecks, parts shortages and skyrocketing shipping costs that have wreaked havoc on corporate budgets in the US and across the globe.

Dad Caps

Dad Caps

Five Panel Hats

Five Panel Hats

Mesh Back Hats

Mesh Back Hats

In Stock Blanks

In Stock Blanks

Snapback Hats

Snapback Hats

Stretchfit Hats

Stretchfit Hats

Duffel Bags

Duffel Bags

Backpacks

Backpacks

Tote Bags

Tote Bags

Computer Bags

Computer Bags

Sling Messenger Bags

Sling Messenger Bags

Cooler Bags

Cooler Bags

Cuff Hats

Cuff Hats

Beanies

Beanies

Scarves

Scarves

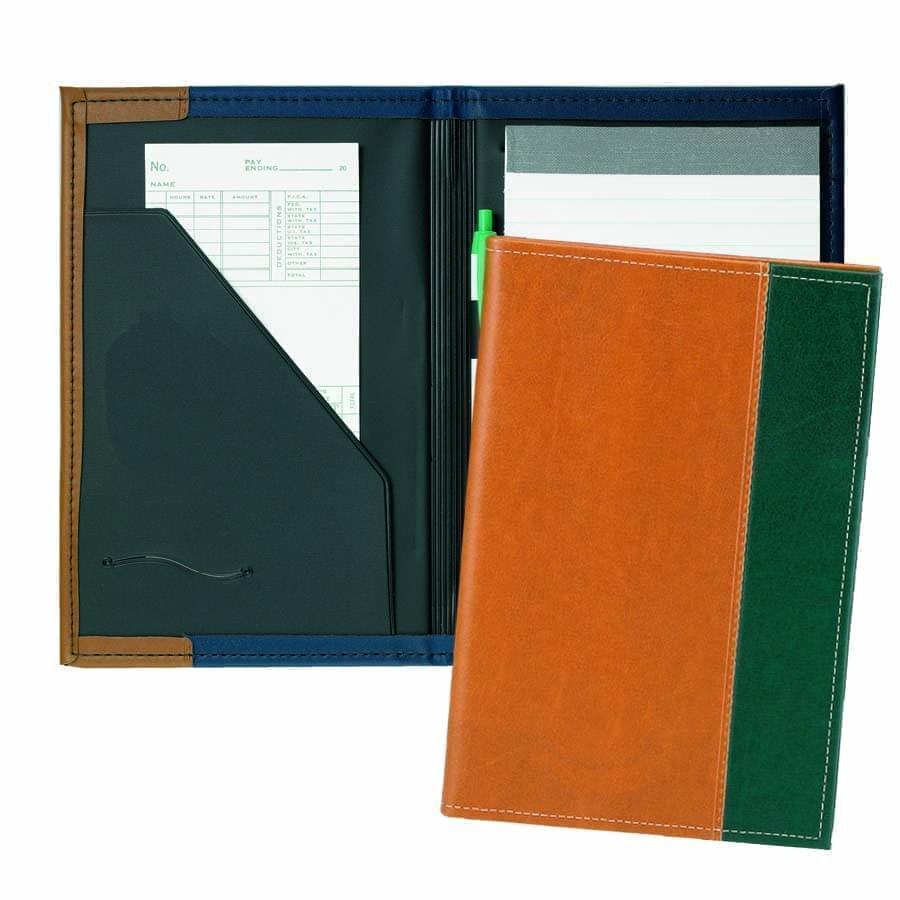

Zipper Folders

Zipper Folders

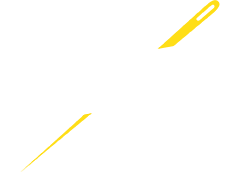

Stitched Folders

Stitched Folders

Accordion Folders

Accordion Folders

Ring Binders

Ring Binders

Letter Folders

Letter Folders

Clipboards

Clipboards

Union Made In USA

Union Made In USA